Pa Sales Tax Exemption Rules . According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. What purchases are exempt from the pennsylvania sales tax? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. While the pennsylvania sales tax of 6% applies to most transactions,. The purchaser gives the completed. How to apply [pdf] isolated sales.

from pafpi.org

The purchaser gives the completed. What purchases are exempt from the pennsylvania sales tax? According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. While the pennsylvania sales tax of 6% applies to most transactions,. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales.

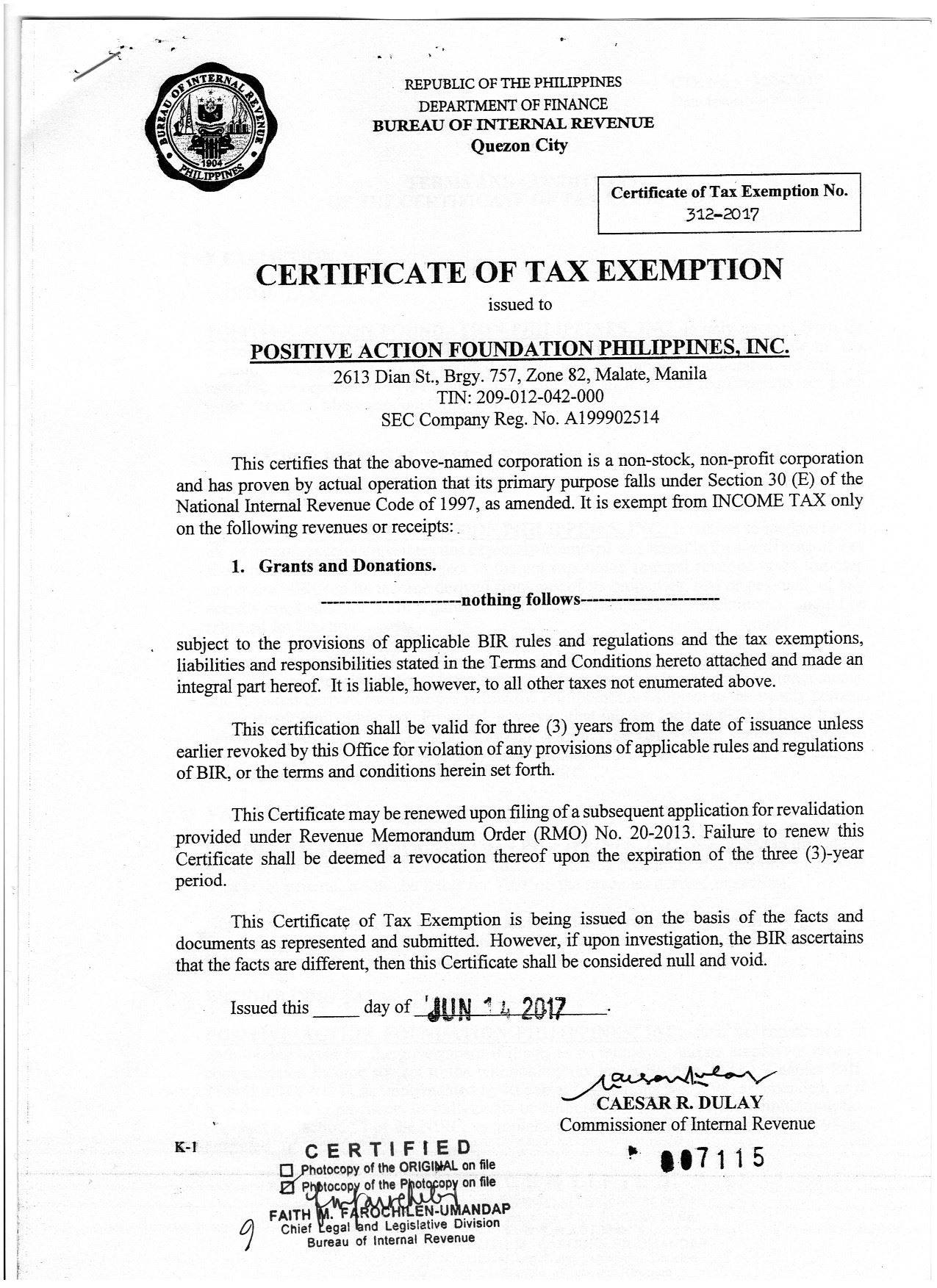

Profiles Archives PAFPI

Pa Sales Tax Exemption Rules While the pennsylvania sales tax of 6% applies to most transactions,. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales. While the pennsylvania sales tax of 6% applies to most transactions,. What purchases are exempt from the pennsylvania sales tax? The purchaser gives the completed. Exemption certificates are required to substantiate all tax exempt sales, except vehicles.

From www.exemptform.com

Form Rev 1220 As Pennsylvania Exemption Certificate 2006 Printable Pa Sales Tax Exemption Rules What purchases are exempt from the pennsylvania sales tax? While the pennsylvania sales tax of 6% applies to most transactions,. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales. The purchaser gives the completed. Exemption certificates are required to substantiate all tax exempt. Pa Sales Tax Exemption Rules.

From www.exemptform.com

Sales And Use Tax Exemption Form Ga Pa Sales Tax Exemption Rules Exemption certificates are required to substantiate all tax exempt sales, except vehicles. How to apply [pdf] isolated sales. While the pennsylvania sales tax of 6% applies to most transactions,. What purchases are exempt from the pennsylvania sales tax? There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. The purchaser. Pa Sales Tax Exemption Rules.

From www.exemptform.com

Pa Sales Taxe Exemption Form Pa Sales Tax Exemption Rules According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. How to apply [pdf] isolated sales. What purchases are exempt from the pennsylvania sales tax? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed. While the pennsylvania sales tax of 6% applies to. Pa Sales Tax Exemption Rules.

From www.dochub.com

Pennsylvania exemption certificate Fill out & sign online DocHub Pa Sales Tax Exemption Rules The purchaser gives the completed. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. While the pennsylvania sales tax of 6% applies to most transactions,. How to apply [pdf] isolated. Pa Sales Tax Exemption Rules.

From www.exemptform.com

In Fill In Sales Tax Exempt Form Pa Sales Tax Exemption Rules While the pennsylvania sales tax of 6% applies to most transactions,. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. What purchases are exempt from the pennsylvania sales tax? According to. Pa Sales Tax Exemption Rules.

From www.exemptform.com

16 H Form For Tax Exemption Pa Sales Tax Exemption Rules How to apply [pdf] isolated sales. What purchases are exempt from the pennsylvania sales tax? While the pennsylvania sales tax of 6% applies to most transactions,. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed. There are exceptions to almost every rule with sales tax, and the same is true for shipping. Pa Sales Tax Exemption Rules.

From www.pdffiller.com

Fillable Online pasalestaxexemptionform.pdf Fax Email Print pdfFiller Pa Sales Tax Exemption Rules The purchaser gives the completed. While the pennsylvania sales tax of 6% applies to most transactions,. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales. What purchases are exempt from the. Pa Sales Tax Exemption Rules.

From www.fivemilehouse.org

Illinois Tax Exempt Certificate — Five Mile House Pa Sales Tax Exemption Rules According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. What purchases are exempt from the pennsylvania sales tax? How to apply [pdf] isolated sales. The purchaser gives the completed. While. Pa Sales Tax Exemption Rules.

From tutore.org

Pennsylvania Exemption Certificate Master of Documents Pa Sales Tax Exemption Rules The purchaser gives the completed. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. What purchases are exempt from the pennsylvania sales tax? There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales. Exemption. Pa Sales Tax Exemption Rules.

From www.pinterest.ph

Tax Exempt Form Request Letter Inspirational Agreement with regard to Pa Sales Tax Exemption Rules The purchaser gives the completed. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. While the pennsylvania sales. Pa Sales Tax Exemption Rules.

From www.exemptform.com

How To Get A Sales Tax Exemption Certificate In Colorado Pa Sales Tax Exemption Rules While the pennsylvania sales tax of 6% applies to most transactions,. How to apply [pdf] isolated sales. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. The purchaser gives the completed. What purchases are exempt from the pennsylvania. Pa Sales Tax Exemption Rules.

From www.exemptform.com

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For Pa Sales Tax Exemption Rules How to apply [pdf] isolated sales. While the pennsylvania sales tax of 6% applies to most transactions,. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. The purchaser gives the completed. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. There are exceptions to almost every rule. Pa Sales Tax Exemption Rules.

From www.exemptform.com

Maryland Sales Tax Exempt Form 2023 Pa Sales Tax Exemption Rules While the pennsylvania sales tax of 6% applies to most transactions,. The purchaser gives the completed. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. What purchases are exempt from the pennsylvania sales tax? How to apply [pdf]. Pa Sales Tax Exemption Rules.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Pa Sales Tax Exemption Rules There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. How to apply [pdf] isolated sales. The purchaser gives the completed. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. Exemption certificates are required to substantiate all tax exempt sales,. Pa Sales Tax Exemption Rules.

From www.lionsdistrict14d.org

Club/District Resources Pa Sales Tax Exemption Rules How to apply [pdf] isolated sales. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. While the pennsylvania sales tax of 6% applies to most transactions,. What purchases are exempt. Pa Sales Tax Exemption Rules.

From www.sanpatricioelectric.org

Tax Exempt Forms San Patricio Electric Cooperative Pa Sales Tax Exemption Rules What purchases are exempt from the pennsylvania sales tax? There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed. How to apply [pdf] isolated sales. According to the institutions of purely public charity. Pa Sales Tax Exemption Rules.

From www.dochub.com

Pa resale certificate pdf Fill out & sign online DocHub Pa Sales Tax Exemption Rules According to the institutions of purely public charity act of 1997, all nonprofit organizations wishing to be exempt from. There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. While the pennsylvania sales tax of 6% applies to most transactions,. What purchases are exempt from the pennsylvania sales tax? How. Pa Sales Tax Exemption Rules.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Pa Sales Tax Exemption Rules There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. The purchaser gives the completed. Exemption certificates are required to substantiate all tax exempt sales, except vehicles. How to apply [pdf] isolated sales. What purchases are exempt from the pennsylvania sales tax? According to the institutions of purely public charity. Pa Sales Tax Exemption Rules.